Financial Planning

Many individuals confuse financial planning with general savings and investing advice. While how to save (and how much!), and where and when to invest those savings, is every bit important, prudent Financial Planning goes much beyond the realm of just saving and investing.

Retirement Planning

When you are young and just starting a professional life, retirement might be the last thing on your mind. However, if you ask any retired person, or someone entering retirement, what advice they would give you about planning for that day, chances are they’ll say: Start as soon as you can!

Investment Planning

Investment planning isn’t just picking stocks or mutual funds…it’s formulating a plan in which to build the optimal asset allocation to meet your specific goals and objectives, while maintaining appropriate levels of risk.

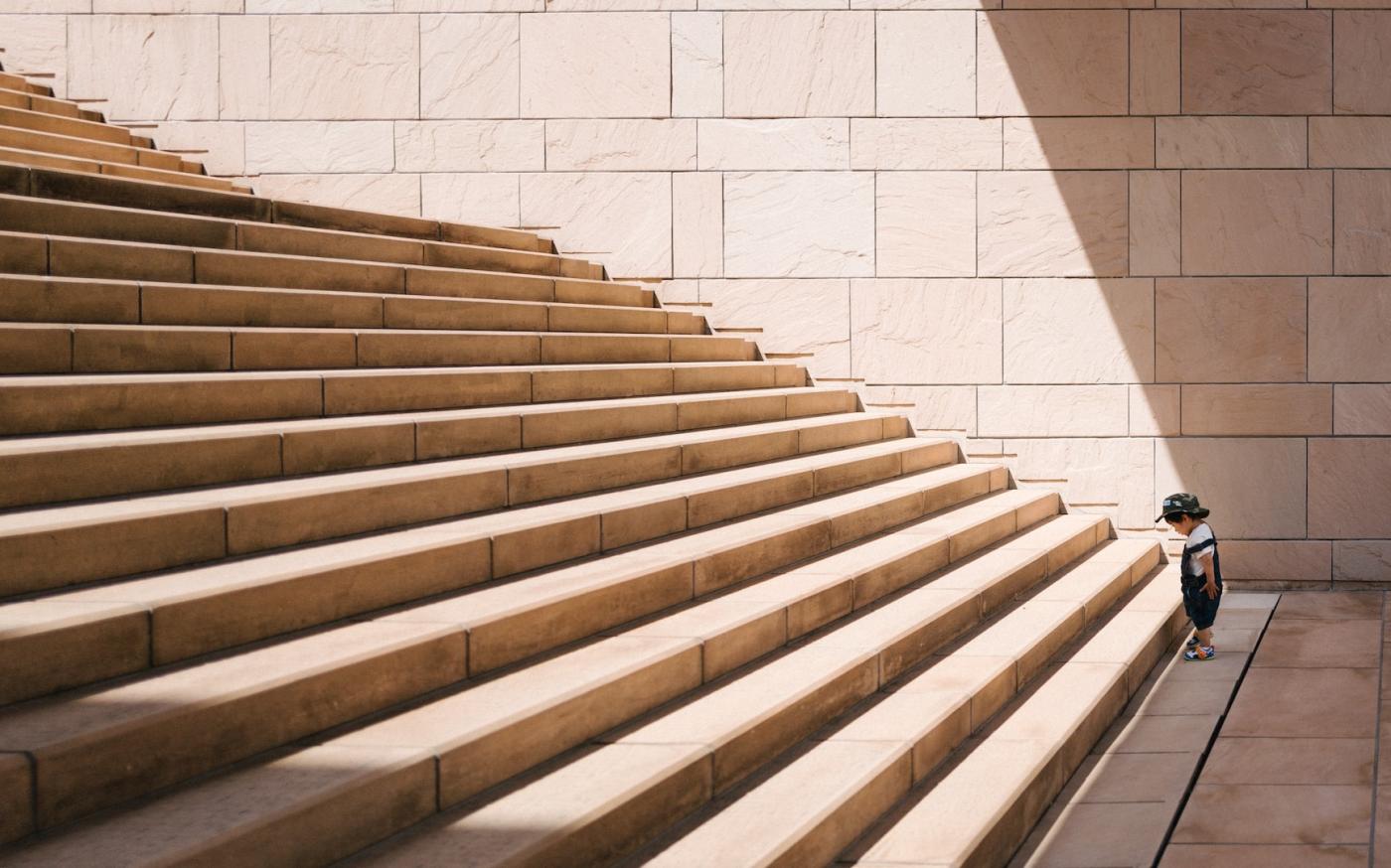

Education Planning

Like Retirement Planning, which has to commence long before you enter into retirement, Education Planning (for yourself or your children) needs to occur well before mature learners or young scholars are poised to embrace higher education.

Life Insurance Planning

If there’s one thing certain about life – it’s the uncertainty that living it brings.